This doesn’t look like a crisis. That’s what makes it dangerous.

No dramatic WTO walkouts. No daily tariff tweets. No emergency summits dominating headlines. And yet, global trade in 2025 is more fragmented than it has been in decades.

The trade war never ended. It evolved. It went bureaucratic. And businesses everywhere are paying for it.

A World Trading With One Hand on the Brake

Globalisation hasn’t reversed, but it has slowed into something more cautious, more political, more conditional.

The US is still imposing selective tariffs. Europe is tightening compliance rules. China is redirecting supply chains inward and southward. Emerging economies are choosing sides quietly, through trade corridors, not press conferences.

The rules of global commerce are no longer universal. They are negotiated, case by case.

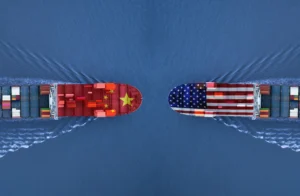

The US–China Economic Standoff Has Gone Structural

What began as tariff skirmishes is now embedded policy.

The US continues to restrict exports of advanced technologies to China, particularly in semiconductors and AI-linked hardware. China, in response, has doubled down on domestic manufacturing and alternative markets.

This is not escalation. It’s entrenchment.

Institutions like World Trade Organization still exist, but enforcement power has weakened. Bilateral agreements and strategic exemptions matter more than multilateral promises.

For global companies, neutrality is harder to maintain. Supply chains are being audited not just for cost, but for political alignment.

Europe Is Regulating Trade Through Compliance

Europe’s approach is subtler, and arguably more disruptive.

The European Union is using regulation as a trade filter. Carbon reporting, digital compliance, data localisation, sustainability disclosures, all of these now act as non-tariff barriers.

If your product doesn’t meet EU standards, it doesn’t matter how cheap or innovative it is. You’re out.

This shifts power from price to paperwork. From scale to compliance sophistication.

Businesses exporting to Europe now factor regulatory readiness as a core cost, not a legal afterthought.

Supply Chains Are Becoming Political Maps

Companies once optimised supply chains for efficiency. Today, they optimise for resilience and accept inefficiency as insurance.

Terms like nearshoring, friendshoring, and China-plus-one are no longer strategy jargon. They are survival tactics.

Manufacturing is spreading across Southeast Asia, Eastern Europe, Mexico, and parts of the Middle East. Not because it’s cheapest, but because it’s politically safer.

Shipping routes, insurance costs, and customs delays now reflect geopolitical tension more than distance.

Trade flows follow alliances, not logic.

Emerging Markets Are Playing the Middle Carefully

Countries across Asia, Africa, and Latin America are navigating this new trade environment with strategic ambiguity.

They trade with China. They court Western capital. They sign regional agreements. They avoid loud alignment.

For them, fragmentation is opportunity. Competing powers bring incentives, funding, and preferential access.

For businesses operating in these regions, this creates volatility and leverage at the same time.

You can gain market access quickly, or lose it overnight.

Trade Is Becoming Slower, Not Smaller

Despite all this, global trade hasn’t collapsed.

It has become slower, more complex, and more expensive.

Contracts take longer. Compliance teams grow. Risk assessments replace optimism. Margins absorb uncertainty.

The winners aren’t the loudest global brands. They’re the quiet operators who understand customs codes, regulatory language, and political mood swings.

Trade today rewards patience and paperwork.

The Business Consequences Are Already Visible

- Inflation stays sticky due to higher import costs

- Multinational earnings become harder to forecast

- Inventory buffers grow, hurting working capital

- Smaller exporters struggle with compliance costs

- Legal and trade advisory services boom quietly

Trade friction is now a permanent background tax on global business.

This Is the New Normal

The idea that trade would naturally become freer over time is gone.

What replaced it is controlled openness. Strategic access. Conditional cooperation.

Borders matter again. Not visibly, but systemically.

For businesses watching global markets, this isn’t a temporary phase. It’s the operating environment for the next decade.

The trade war didn’t return with noise.

It returned with rules.