In the weeks leading up to Nvidia’s third-quarter earnings report, investors debated whether the markets were in an AI bubble, fretting over the massive sums being committed to building data centers and whether they could provide a long-term return on investment.

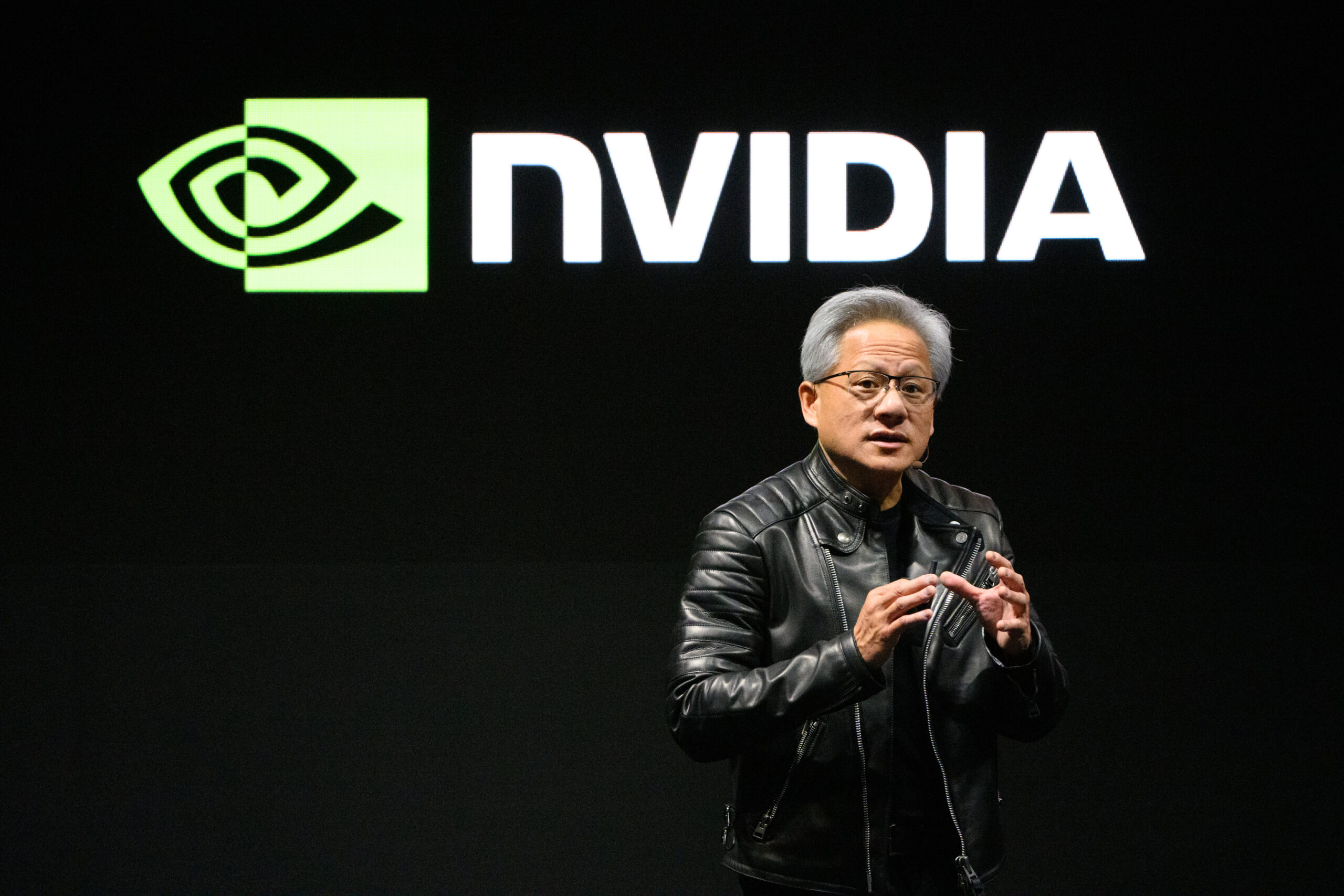

During Wednesday’s earnings call with analysts, Nvidia CEO Jensen Huang began his comments by rejecting that premise. “There’s been a lot of talk about an AI bubble,” Huang said. “From our vantage point we see something very different.”

In many respects, Huang’s remarks are to be expected. He’s leading the company at the heart of the artificial intelligence boom, and has built its market cap to $4.5 trillion because of soaring demand for Nvidia’s graphics processing units.

Huang’s smackdown of bubble talk matters because Nvidia counts every major cloud provider — Amazon, Microsoft, Google, and Oracle — as a customer. Most of the major AI model developers, including OpenAI, Anthropic, xAI and Meta, are also big buyers of Nvidia GPUs. Huang has deep visibility into the market, and on the call he offered a three-pronged argument for why we’re not in a bubble.

First, he said that areas like data processing, ad recommendations, search systems, and engineering, are turning to GPUs because they need the AI. That means older computing infrastructure based around the central processor will transition to new systems running on Nvidia’s chips.

Second, Huang said, AI isn’t just being integrated into current applications, but it will enable entirely new ones. Finally, according to Huang, “agentic AI,” or applications that can run without significant input from the user, will be able to reason and plan, and will require even more computing power.

In making the case of Nvidia, Huang said it’s the only company that can address the three use cases. “As you consider infrastructure investments, consider these three fundamental dynamics,” Huang said. “Each will contribute to infrastructure growth in the coming years.”

Reversing the slide

In its earnings release, Nvidia reported revenue and profit that sailed past estimates and issued better-than-expected guidance. Last month, Huang provided a $500 billion forecast for sales of the company’s AI chips over calendar 2025 and 2026.

The company said on Wednesday that its order backlog didn’t even include a few recent deals, like an agreement with Anthropic that was announced this week or the expansion of a deal with Saudi Arabia.