Rethinking Carbon Capture

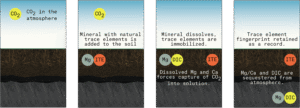

When you picture giant machines sucking CO₂ from the sky, think again. In a Midwest field this year, the strategy looks much more like a tractor and a bag of crushed green rock. Eion, an Oakland-based startup, has built a business around enhanced rock weathering, a simple but scientifically grounded idea: spread finely ground olivine on farmland, let rain and soil chemistry do the work, and permanently lock carbon away while improving soil health. The company calls it “carbon removal that fits farming,” and corporations willing to pay for verified, permanent removals are taking notice.

A Founding Team That Bridges Science and Soil

Eion was founded in 2020 by Dr Elliot Chang and Adam Wolf, and is led today by CEO Anastasia Pavlovic, whose background blends agronomy, operations, and climate markets. The company stacks farmers, mineral-process engineers, soil scientists, and carbon-market experts. That mix matters. Eion’s credibility rests less on lofty lab claims and more on field trials, partnerships with distributors, and a patented soil “fingerprinting” method that links olivine weathering to tonnes of CO₂ removed.

The Urgent Market Opportunity

Demand for verifiable carbon removal has shifted from niche to urgent. Corporates and governments now need durable removals, not temporary offsets, to meet net-zero targets. While direct air capture is capital intensive and slow to scale, enhanced rock weathering promises lower capital barriers and near-term deployment across millions of agricultural acres. Eion positions itself at that intersection: addressing climate risk, and offering farmers a substitute for ag lime that can save money while sequestering carbon.

A Practical and Profitable Business Model

Eion’s pitch is practical. Replace the lime farmers already buy with olivine, pay farmers part of the removal revenue, and sell verified carbon credits to corporate buyers. Eion measures change with before-and-after soil sampling, a method it has patented and expects to license. The company’s recent offtake deal through Frontier, the high-profile buyer coalition, priced removals at just under $420 a ton for that deal, showing corporate willingness to pay a premium for permanence and robust measurement.

Traction and Early Wins

Traction is concrete. In March 2025 Eion secured a $33 million purchase agreement — 78,707 tons of removals between 2027 and 2030 — brokered via Frontier. The company has partnerships with agricultural co-ops such as Growmark, opening access to hundreds of thousands of acres and the farmer networks that make scaling realistic. Eion claims it can reach 10 million tons of removals annually by 2030 if deployment accelerates. Those are ambitious numbers, but the playbook is clear: integrate into existing ag supply chains and scale like an ag input business.

Rivals, Risks, and Room to Grow

Eion sits alongside direct air capture firms, biochar players, and other ERW groups such as UNDO. Its advantages are operational simplicity and lower capex. The risks are measurement costs, regulatory scrutiny, and the need to prove permanence at scale. For acquirers, Eion’s appeal is obvious: a validated route into large-volume, durable removals plus farmer channels that could be folded into agribusiness, fertilizer, or commodity companies. An exit to an ag major, a large carbon-services firm, or a climate-forward corporation seems plausible within five to eight years, provided verification and cost curves improve.

Vision and Financial Discipline

Eion sells a simple story: profitable climate action that helps farmers. That narrative has traction because it ties social and environmental value to an existing cashflow model. The company recognizes the need for rigorous, audited verification and finances projects by recognising revenue as credits are verified and delivered, smoothing cash flow across long projects. Investors buying permanence are buying more than PR, they are buying audited science and supply chains.

The Road Ahead

Eion is not reinventing chemistry. It is a rewiring distribution. If its measurement holds up and costs fall, enhanced rock weathering could become one of the few carbon removal pathways that scales fast and integrates with rural economies. For an industry that needs gigaton-scale solutions, a field of crushed rock might be the humble, high-impact tool the planet can actually use.