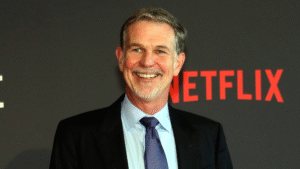

The year was 1997. Reed Hastings, fresh from selling Pure Software for $750 million, was carpooling from Santa Cruz to Sunnyvale with Marc Randolph, his marketing director. Both men were at a crossroads, wealthy enough to retire young, restless enough to want more.

During those long commutes, conversation inevitably turned to business. Randolph, who had co-founded computer mail-order company MicroWarehouse, was obsessed with a question: What could be the Amazon.com of something? They threw around ideas. Dog food? Too heavy. VHS tapes? Too fragile, too expensive to ship.

Then they heard about DVDs, a new format just hitting American markets in early 1997. They walked into Logos Books & Records in Santa Cruz on a sweltering summer day, bought a Patsy Cline CD, slipped it into an envelope, and mailed it to Hastings’ house a few blocks away. The next morning, it arrived intact.

“When the disc arrived unbroken, we knew we had found our ticket to e-commerce glory,” Randolph would later recall.

On August 29, 1997, Netflix was born.

What happened next is a story of ridiculous gambles, spectacular near-failures, and a relentless ability to bet the company on what’s next. Today, Netflix stands as one of the world’s 20 most valuable companies, with a market capitalisation of $528.53 billion and quarterly revenues exceeding $11 billion. But the path from that CD test to global domination was anything but smooth.

The Early Days: DVDs, Rejection, and Survival

The early days weren’t easy. Netflix started with a per-rental model, charging customers for each DVD they rented. It wasn’t working. In September 1999, Hastings implemented a subscription-based business model that would prove transformative. Barry McCarthy, Netflix’s CFO from inception till 2010, said: “It was Reed’s insight that the subscription model would resonate with consumers. We began to grow exponentially overnight. In 1998, the business did $1 million in revenue. In 1999, we did $5 million, then $35 million”.

But survival wasn’t guaranteed. Founded during the dot-com bubble, Netflix struggled like many internet companies. In September 2000, Hastings and Randolph offered to sell the company to Blockbuster for $50 million. John Antioco, CEO of Blockbuster, the rental giant, dismissed it as a joke

Antioco laughed them out of the room. “The dot-com hysteria is completely overblown,” he told them. It would prove to be one of the most expensive mistakes in business history.

And it was the best rejection Netflix ever received. Had Blockbuster bought them, there would be no Netflix today, and Blockbuster might still exist.

The Founder Dynamic: Vision Meets Execution

Marc Randolph is the first to admit that he and Reed Hastings were different animals. Randolph was the marketer, the optimist, the guy who loved the scrappy startup phase. Hastings was the engineer, the data-obsessed strategist, the one thinking three moves ahead.

Their equity split reflected this reality. And in 1999, when growth stalled after a Sony partnership fell through, Hastings demoted Randolph to president and assumed the CEO role himself. It was a brutal but necessary decision. This wasn’t just about money; it was about control. Randolph stayed on until 2002, shepherding the company through its IPO before departing to mentor other startups.

“Reed and I were in sync about what needed to happen,” Randolph said years later. “Netflix needed someone who could scale it to 93 million subscribers worldwide. That person was Reed, not me.”

The Streaming Revolution

Netflix launched streaming on January 16, 2007, introducing its “Watch Now” feature a major shift from its DVD-by-mail model. It was a calculated gamble. The infrastructure wasn’t fully ready. Internet speeds were still catching up. But Hastings saw the future clearly.

Today, that vision has materialised spectacularly. As of early 2025, Netflix has over 301 million paid subscribers globally, operates in over 190 countries, and generated approximately $39 billion in revenue in 2024, up roughly 15-16% from 2023. In Q1 2025, revenue reached $10.54 billion, up 12.5%, with operating margin expanding to 31.7%.

The business model has evolved beyond pure subscription. Netflix introduced an ad-supported tier, and by mid-2025, roughly 94 million users were on this plan. Ad revenue is expected to double in 2025, with the company aiming to grow it to $9 billion by 2030.

By 2010, streaming had become Netflix’s core business model. By 2016, it was available in over 190 countries. And in 2022, Netflix finally shut down its DVD division, ending an era, but cementing its future.

The House of Cards Gamble: Becoming a Studio

By 2011, Netflix faced a new existential threat: content owners were pulling their shows to launch their own streaming services. Disney, Warner Bros., and NBC all saw Netflix as a competitor, not a partner. If Netflix lost access to licensed content, it would have nothing to stream.

The solution? Become a content creator.

In 2011, Netflix took a massive, unprecedented gamble. It didn’t order a pilot for House of Cards, the political drama based on a British series. It is committed to two full seasons—26 episodes upfront, for an estimated $100 million. No TV network had ever done that. The decision was driven by data: Netflix knew its subscribers loved Kevin Spacey, loved director David Fincher, and loved the original British House of Cards.

When House of Cards premiered on February 1, 2013, Netflix released all 13 episodes at once. Binge-watching was born. The show was a massive critical and commercial hit. It proved Netflix could not just distribute content; it could also create it.

A few months later, Orange Is the New Black launched. Then Stranger Things. The Crown. Narcos. Squid Game. Wednesday. By 2022, Netflix Originals accounted for half of its U.S. library.

In 2024, Netflix spent $16.2 billion on content. In 2025, that number is expected to hit $18 billion. That’s more than most Hollywood studios spend annually, and Netflix is doing it globally, in multiple languages, for 190 countries.

Ted Sarandos, Netflix’s co-CEO and Chief Content Officer, has been the architect of this strategy. Hired in 2000, Sarandos championed data-driven content decisions, global storytelling, and giving creators unprecedented freedom. His mantra: “Don’t just compete with HBO. Become HBO before HBO becomes Netflix.”

Netflix Today: The Streaming Juggernaut

As of August 2025, Netflix has 301.6 million paid subscribers globally, up from 260 million just a year earlier. In Q2 2025 alone, it generated $11.08 billion in revenue, a 16% year-over-year increase. Operating income hit $3.77 billion, and net income reached a record $3.125 billion.

The company’s content strategy is now truly global. Squid Game, a South Korean survival drama, became Netflix’s most-watched show ever. Money Heist from Spain, Dark from Germany, Sacred Games from India, and Lupin from France. Netflix is producing hits in dozens of languages and exporting them worldwide.

Netflix has also entered new arenas: live sports, gaming, and even live events. It’s negotiating for more sports rights, exploring interactive content, and investing heavily in AI and personalisation.

The company’s recommendation algorithm drives 80% of viewing. On average, users spend 63 minutes per day on Netflix, and the company processes billions of data points to keep them hooked.

The Funding Journey: Lessons for Founders

For entrepreneurs, Netflix’s funding story offers valuable lessons. In 1999, Netflix received its first major venture capital funding of $30 million from Institutional Venture Partners and Technology Crossover Ventures. TCV led the Series C in early 1999 with $6 million, then invested $40 million in April 2000, ten days before the dot-com bubble burst.

By the time of its IPO, TCV owned roughly 34% of the company, a stake worth approximately $102 million. The lesson? Patient capital matters. TCV stayed invested through the public markets, believing in the long-term vision even when quarterly metrics looked uncertain.

Since its founding, Netflix has raised roughly $5 billion across multiple funding rounds, transitioning from equity fundraising in its startup phase to large-scale debt financing post-IPO. The company has made two investments in other companies and acquired 13 companies, focusing on technology and content capabilities rather than sprawling diversification.

Today, Netflix’s market capitalisation stands at $528.53 billion, making it one of the world’s 20 most valuable companies ahead of many traditional media giants.

Acquisitions: Small Bets, Big Impact

Unlike competitors such as Disney (which bought Marvel and Lucasfilm) or Amazon (which acquired MGM Studios for $8.45 billion), Netflix has taken a different approach to acquisitions. It prefers to build rather than buy.

To date, Netflix has made 13 acquisitions, with a combined value of less than $1 billion, pocket change compared to industry peers. Its largest acquisition was the Roald Dahl Story Company in 2021 for over $700 million, giving Netflix access to beloved characters like Matilda, Charlie, and the BFG.

Netflix has also invested strategically in production infrastructure. In 2020, it acquired Grauman’s Egyptian Theatre in Los Angeles. It has spent $700 million expanding production facilities in South Korea. It’s built studios in Europe, Latin America, and Africa.

The strategy is clear: own the tools of production, control the IP, minimise reliance on external studios.

The Culture That Built an Empire

What truly sets Netflix apart isn’t just its technology or content, it’s its radical approach to workplace culture. In August 2009, Reed Hastings published a 125-page PowerPoint presentation titled “Netflix Culture: Freedom & Responsibility”. The document has been viewed over 5 million times and fundamentally influenced how tech companies think about talent.

The principles are unconventional: Netflix has no vacation policy and no expense policy beyond “act in Netflix’s best interests”. The company practises the “Keeper Test”; managers must constantly ask themselves if they would fight to keep an employee. If the answer is no, it’s time to let that person go. Adequate performance gets a generous severance package, not a second chance.

This isn’t ruthlessness, it’s clarity. The culture memo emphasises hiring “stunning colleagues” and giving them context rather than control. Netflix expects managers to practice “context not control”, giving teams the clarity needed to make good decisions instead of trying to control everything.

Hastings himself has said, “We’re a pro sports team, not a kid’s recreational team.”

Lessons for Startup Founders: The Netflix Playbook

What can founders learn from Netflix’s journey? Here are five takeaways:

1. Pivot Early and Often, But Stay True to Your Vision: Netflix has reinvented itself multiple times: from DVD sales to DVD rentals, from per-rental fees to subscriptions, from mail-order to streaming, from licensing to original content. But the vision never changed: reduce friction in accessing entertainment. Know your North Star, but be ruthless about tactics.

2. Data Is Your Superpower: Netflix didn’t greenlight House of Cards on gut instinct. It analysed 30 million plays, 4 million ratings, and 3 million searches to know exactly what its audience wanted. Use data to derisk big bets.

3. Bet the Company When You’re Right: In 2007, Netflix’s DVD business was booming. Launching streaming was expensive, uncertain, and could cannibalise the core business. Hastings did it anyway. In 2013, Netflix was a distribution platform. Becoming a studio was risky and capital-intensive. Sarandos pushed forward. Bold moves separate market leaders from followers.

4. Culture Eats Strategy for Breakfast: Netflix’s culture of freedom and responsibility isn’t just feel-good HR speak. It’s the operating system that allows the company to move fast, innovate constantly, and attract top talent. Culture is as important as product.

5. Own Your Distribution and Your Content: Early Netflix relied on studios for content and the postal service for distribution. Over time, it built both. If you want to control your destiny, own the value chain.

Lessons for Investors: What Netflix Gets Right

What makes Netflix a compelling investment case even at a $528 billion valuation? Three things:

1. Recurring Revenue Model: Subscriptions create predictable, recurring cash flow. Unlike transactional businesses, Netflix knows exactly how much revenue it will generate each month. This allows for long-term planning and investment.

2. Global Scalability: Netflix operates in 190 countries. A hit show in South Korea (Squid Game) becomes a global phenomenon. Content created in Spain (Money Heist) drives subscriptions in Brazil. The platform effect is powerful.

3. Defensibility Through Data and Content: Netflix’s recommendation engine and massive content library create switching costs. Once you’re hooked, it’s hard to leave. And with 18,000+ titles and $18 billion in annual content spend, competitors struggle to match breadth and quality.

Investors should note: Netflix’s stock has had wild swings. It fell 75% in 2011. It dropped 50% in 2022. But over 20 years, it’s delivered 30,000%+ returns. The lesson? Great companies go through turbulence. Long-term believers are rewarded.

![]()

What’s Next for Netflix?

Netflix’s executives have set an audacious goal: double revenue to approximately $80 billion and triple operating income to $30 billion by 2030, targeting a $1 trillion market valuation. The company aims to reach roughly 410 million subscribers by 2030.

Netflix projected an $18 billion content investment for 2025, following $17 billion in 2024. The company is expanding into live sports, gaming, and interactive content. It has licensed World Wrestling Entertainment and invested in anime, which has seen 300% streaming growth over five years.

The company that started with a mailed CD has transformed into a global entertainment empire. It’s a case study in vision, execution, resilience, and relentless innovation.

The Final Reel

Twenty-eight years ago, two guys tested whether a CD could survive being mailed. Today, that test has become a $528 billion company that touches the lives of over 300 million people every single day.

Netflix didn’t just disrupt Blockbuster. It redefined television, challenged Hollywood, and changed how the world consumes stories. It proved that data beats intuition, that bold bets pay off, and that culture matters as much as strategy.

For founders, the lesson is clear: think big, move fast, and never stop reinventing yourself.

For investors, it’s equally clear: find companies that own their destiny, build moats, and compound value over time.

Netflix is far from perfect. It’s made mistakes, faced setbacks, and navigated near-death experiences. But it’s survived because it never stopped asking: What’s next?

And in a world where standing still is death, that question is the only one that matters.

Netflix Timeline — Key Milestones

1997: Company founded by Hastings and Randolph

1998: Netflix launches with DVD-by-mail

1999: Introduces subscription model

2002: Goes public at $15 per share

2007: Launches streaming service

2013: Debuts first original series, House of Cards

2016: Expands to 190 countries

2024: Reaches 301 million subscribers, $39 billion revenue

2025: Co-CEOs Greg Peters and Ted Sarandos lead; Hastings becomes chairman

*This story draws from publicly available sources, including Netflix investor relations filings, interviews with founders Marc Randolph and Reed Hastings, SEC filings, business press coverage, and industry analysis. All financial figures and subscriber counts are accurate as of August 2025